Matthew D. Favreau, Director and Addison B. Dascombe, Client Advisor, New Republic Partners

The House Ways and Means Committee has proposed new tax legislation related to the potential new infrastructure plan. The changes result in increased taxation on high-income earners and corporations.

The most significant potential changes for ultra-high net worth families are focused on gift and estate tax laws and strategies. In this column, we’ll cover the lifetime exemption, grantor trusts, valuation discounts, income tax changes, and changes that could affect your retirement planning.

Lifetime Exemption

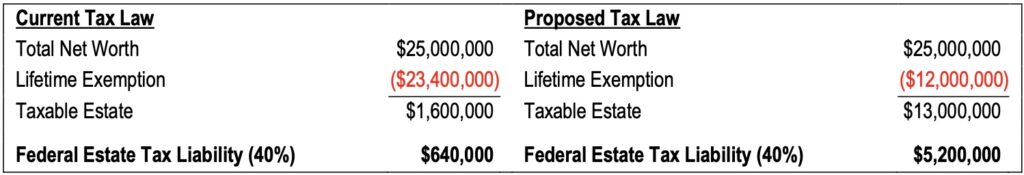

The maximum amount which an individual can pass free of gift and estate taxes is currently $11.7 million, or $23.4 million for a married couple. This amount is called the lifetime exemption and is scheduled to revert to $5 million, indexed for inflation, in 2026. Under the legislation put forward, this amount will reduce to $5 million plus inflation effective January 1, 2022. The simple example below may better illustrate the impact:

Ultra-high net worth families may wish to consider using their lifetime exemption before it is reduced at the end of the year, should legislation pass.

Grantor Trusts

In addition to the reduced lifetime exemption amount, many estate planning strategies common among ultra-high net worth families will be impacted. Under the proposed legislation, grantor trusts will be included in the taxable estate if the deceased is deemed an owner of the trust. The provision also treats the sales between grantor trusts and their owner as sales to a third party.

The tax advantages of Grantor Retained Annuity Trusts (GRATs) would be eliminated under the planned legislative changes. GRATs allow the grantor to place assets in a trust, receive distributions based on the contributed value for at least two years, then pass the remaining growth tax free. Under the proposed law, assets will either fall back into the grantor’s taxable estate and be subject to estate taxes or pass to beneficiaries and be deemed a taxable gift.

Intentionally Defective Grantor Trusts (IDGTs) would also lose their tax advantages if the new legislation is passed. IDGTs allow the grantor to remove an asset from their taxable estate while still maintaining the income tax liability. The income tax payments made by the grantor reduce the tax drag typically associated with non-grantor trusts.

Other grantor trusts whose benefit may be limited include:

▪ Spousal Lifetime Access Trusts (SLATs)

▪ Irrevocable Life Insurance Trusts (ILITs)

▪ Qualified Personal Residence Trusts (QPRTs)

You may wish to talk with your client advisor about your grantor trusts in light of these potential changes.

Valuation Discounts

Ultra-high net worth families often transfer assets into a family limited partnership (FLP) before gifting a non-voting, minority interest to their children at a discounted value. The non-controlling interest is often discounted between 15-35% depending on the assets transferred. Under the proposed legislation, valuation discounts are disallowed for passive, non-business assets.

Most of the potential changes to grantor trusts and valuation discounts begin on the date that the new law is enacted, likely before the end of the year. With this in mind, ultra-high net worth families that would like to utilize grantor trusts or valuation discounts may wish to consider immediate implementation.

Corporate, Individual and International Income Taxes

Other proposed changes focus on corporate and individual income tax rates, international taxation, and retirement planning. Some of the more relevant changes include:

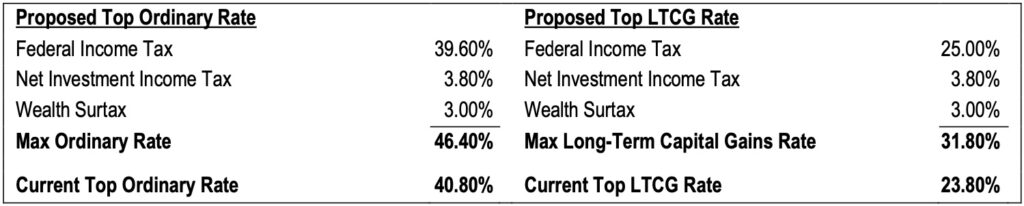

▪ Top ordinary income tax rate of 39.6% (up from 37%)

▪ Top long-term capital gains income tax rate of 25% (up from 20%)

Unlike other proposed changes that begin on January 1, 2022, changes to long-term capital gains rates are effective as of September 13, 2021. A transition rule allows the existing 20% rate to apply to gains that arise from transactions entered into beforeSeptember 13, 2021, pursuant to a written contract.

▪ A new 3% surtax on adjusted gross income over $5 million

▪ Expansion of the 3.8% net investment income tax to include the net investment income derived in the ordinary course of a trade or business (excludes wages)

▪ Top corporate tax rate of 26.5% (up from 21%)

A graduated structure has been proposed based on income. The structure is phased out if income exceeds $10 million.

▪ Qualified Business Income (QBI) deduction limitations dependent on income

▪ Limit the Qualified Small Business Stock (QSBS) exclusion to 50% dependent onincome. Effective on all sales occurring on or after September 13, 2021

▪ Permanently disallow deductions for business losses (those that exceed business income) in excess of $500,000

▪ Subjecting digital assets to wash sale rules. The wash sale rule states that if a securityis sold at a loss and repurchased within 31 days, the prior loss will be disallowed.

▪ Changes to carried interest holding period requirements for preferential tax treatmentto five years (up from three years)

▪ Corporate foreign earnings tax rate of 16.6% (up from 10.5%)

Retirement Planning

Proposed changes that can affect retirement planning include:

IRA contributions prohibited if combined retirement balance exceeds $10 million

▪ Mandatory 50% minimum distribution on retirement balance exceeding $10 million

▪ Mandatory 100% minimum distribution on retirement balance exceeding $20 million

▪ Removal of “back-door” Roth IRA conversions dependent on income

The proposed legislation did not mention changes to the “step-up” in basis at death, increases to the federal gift and estate tax rate of 40%, and the expansion of the $10,000 SALT deduction cap. These items may be included at later dates.

While the suggested legislation will no doubt be subject to further revisions, we recommend a discussion of your financial plan with the possible impact of these proposals in mind. We welcome the opportunity to consult with you in this regard, in full partnership with your estate counsel and tax professional.

Find out which tax-planning strategies may be valuable to you prior to year-end.

Addison B. Dascombe is a client advisor at New Republic Partners. He brings expertise in a wide spectrum of industry specialties, including financial planning for personal and philanthropic goals, estate and succession strategy, insurance structures, wealth advisory, investment strategies and tax management.

Matthew D. Favreau is a director at New Republic Partners. He draws on two decades of experience in financial services as an institutional consultant to endowments and foundations and as a wealth advisor to high-net-worth families and individuals.

Reach Addison and Matthew at info@newrepublicpartners.com

About New Republic Partners

New Republic Partners is an innovative investment management and wealth advisory firm serving affluent families, RIAs, endowments and foundations. We believe that clients benefit from access to investment opportunities usually reserved for large institutional investors and the expertise and experience of a successful and seasoned investment management, wealth advisory and family office solutions team. The firm is headquartered in Charlotte, North Carolina, and serves clients across the U.S. with regional offices. More information can be found at New Republic Partners.

New Republic Partners is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about New Republic Partners’ advisory services can be found in its Form ADV Part 2 and/or Form CRS, which are available upon request. Material presented has been derived from sources considered to be reliable, but accuracy and completeness cannot be guaranteed.

The opinions expressed are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward-looking statements cannot be guaranteed.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The MSCI ACWI NR Index is a global equity index that captures large and mid-cap representation across 23 developed markets and 27 emerging markets. The index covers approximately 85% of the global investable equity opportunity set.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The Index is frequently used as a stand-in for measuring the performance of the U.S. bond market. In addition to investment grade corporate debt, the Index tracks government debt, mortgage-backed securities (MBS) and asset-backed securities (ABS) to simulate the universe of investable bonds that meet certain criteria. In order to be included in the Index, bonds must be of investment grade or higher, have an outstanding par value of at least $100 million and have at least one year until maturity.

The volatility (beta) of an account may be greater or less than its respective benchmark. It is not possible to invest directly in an index. Past performance is not indicative of future results.